Electronics imports in May 2024 decreased by 1.18% to US$ 2.15 billion, which is 19.68% of the country’s US$ 10.93 billion total commodity imports.

Fig. 1: PH Electronics Imports (April 2024 vs May 2024)

The country’s electronics imports shrunk by 1.18% from US$ 2.18 billion in April 2024 to US$ 2.15 billion in May 2024. See Fig. 1.

Five (5) sectors went down, led by Medical/Industrial Instrumentation at 33.55%,

from US$ 24.18 million to US$ 16.07 million. It was followed by Office Equipment (26.79%), Communication/Radar (24.40%), Electronic Data Processing (15.88%), and Telecommunication (3.30%).

Four electronics sectors rose, led by Automotive Electronics (53.27%), from US$ 2.91 million to US$ 4.46 million. This was followed by Semiconductor Components/Devices (3.76%), Consumer Electronics (3.55%), and Control and Instrumentation (0.28%).

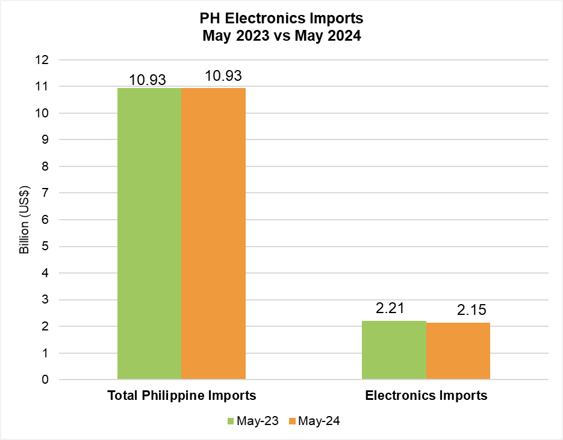

The electronics imports declined by 2.49%, from US$ 2.21 billion in May 2024 to US$ 2.15 billion in May 2024, as shown in Fig. 2.

Imports for six (6) sectors decreased, led by Automotive Electronics at 22.27%, from US$ 5.74 million to US$ 4.46 million, as shown in Table 2. It was followed by Medical/Industrial Instrumentation (18.42%), Office Equipment (14.68%), Communication/Radar (7.09%), Semiconductor Components/Devices (6.70%), and Control and Instrumentation (2.05%).

Three (3) sectors went up, namely Consumer Electronics (34.93%), Electronic Data Processing (18.18%), and Telecommunication (6.39%).

Fig. 2: PH Electronics Imports (May 2023 vs May 2024)

Fig. 3: PH Electronics Exports (January – May 2023 vs. January – May 2024)

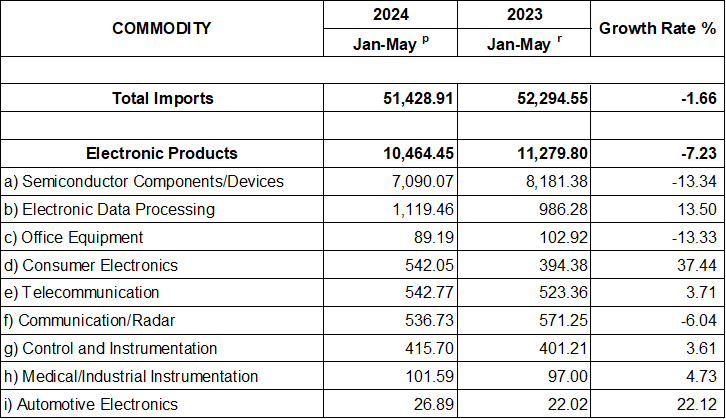

Cumulative electronics imports went down by 7.23%, from US$ 11.28 billion in 2023 to US$ 10.46 billion in 2024. These comprised 20.35% of the total Philippine commodity imports YTD (See Fig. 3).

Three (3) electronics sectors decreased, led by Semiconductor Components/Devices (13.34%) from US$ 8.18 billion to US$ 7.09 billion. It was followed by Office Equipment (13.33%), and Communication/Radar (6.04%).

Meanwhile, Automotive Electronics increased by 37.44%, from US$ 394.38 million to US$ 542.05 million. This was followed by Automotive Electronics (22.12%), Electronic Data Processing (13.50%), Medical/Industrial Instrumentation (4.73%), Telecommunication (3.71%), and Control and Instrumentation (3.61%). Kindly refer to Table 3.

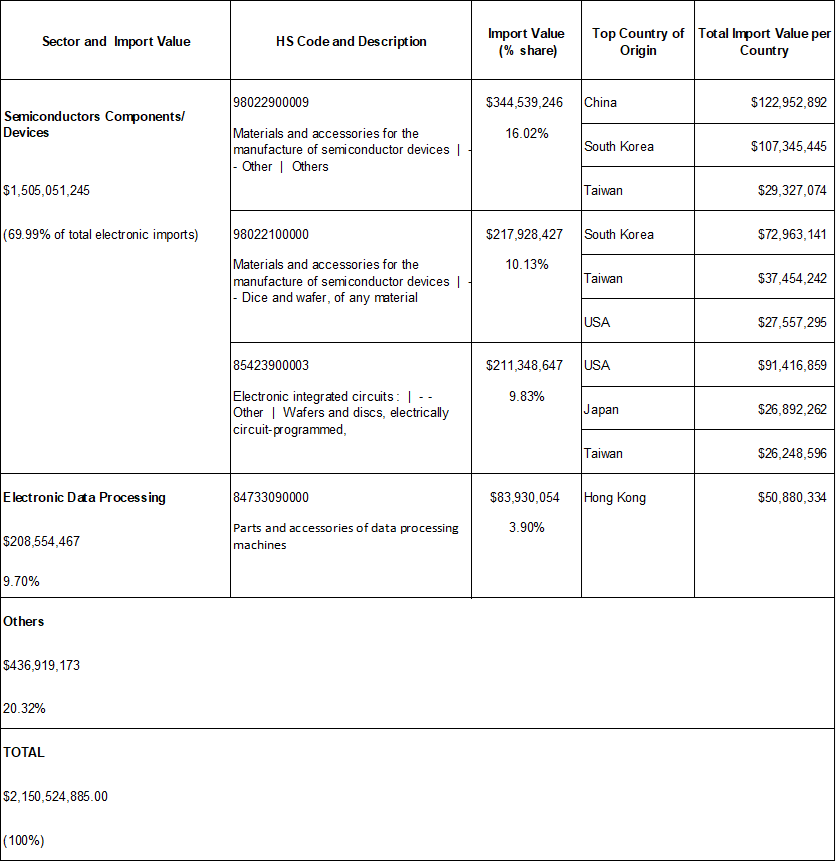

COUNTRIES OF ORIGIN (MAY 2024)

Table 1 shows that the top five (5) countries of origin of electronics imports in May 2024 were China (27.16%), South Korea (13.08%), Japan (10.55%), the USA (9.10%), and Taiwan (8.15%).

Table 1: Top 5 Countries of Origin for Electronics Imports (April 2024 vs May 2024)

The rest of the top ten countries of origin were Singapore (7.92%), Hong Kong (6.00%), Malaysia (4.54%), Thailand (2.96%), and Vietnam (2.46%).

Fig. 4: Top Imported Products (May 2024)

Fig. 4 shows the top imported electronics products in May 2024. Dice and wafer under semiconductors components/ devices imported from South Korea increased by 100.44%. Meanwhile, materials and accessories for the manufacture of semiconductor devices imported from South Korea decreased by 6.52%. See Table 3.

Table 2: PH Electronics Imports Product by Sector (Month-on-Month and Year-on-Year)

Table 3: PH Electronics Imports Product by Sector (Year-to-date)

Table 4: PH Top Electronics Import Products and Countries of Destination